By Aaron Miller-

Allen Weisselberg, the friend of chief financial officer of former U.S president Donald Trump, was given five months in jail for accepting $1.7m in perks without paying tax.

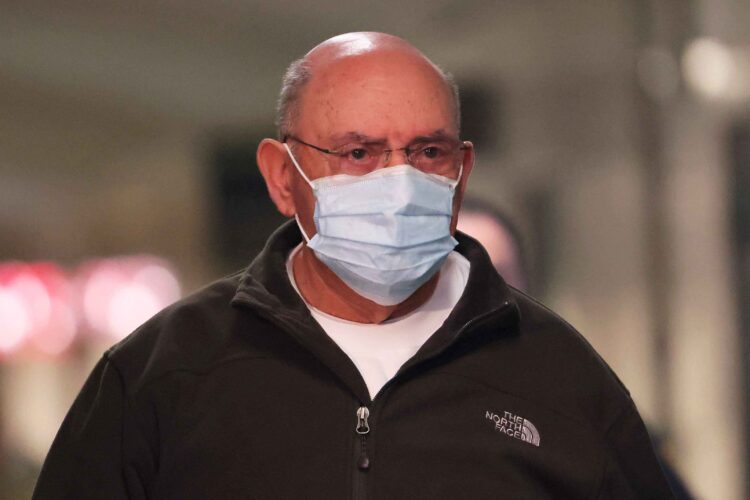

Weisselberg, 75,(pictured) was sentenced in August, after he agreed to plead guilty to 15 tax crimes and testify against the Trump Organization, where he has worked since the mid-1980s and was chief financial officer at the time of his arrest.

Following testimony that helped convict Donald Trump’s company of tax fraud, Allen Weisselberg, a longtime senior executive, was given five months in jail for accepting $1.7m in perks without paying tax.

Weisselberg, was sentenced in August when he agreed to plead guilty to 15 tax crimes and testify against the Trump Organization, where he has worked since the mid-1980s and was chief financial officer at the time of his arrest.

As part of the plea agreement, the judge, Juan Manuel Merchan, ordered Weisselberg to pay nearly $2m in taxes, penalties and interest, which as of 3 January he had paid. The judge also sentenced Weisselberg to five years’ probation.

Judge Juan Merchan on Tuesday said had he not already promised a five-month sentence to Weisselberg, he would have issued a stiffer sentence “much greater” than five months after listening to evidence at trial.

Weisselberg escaped the maximum 15 year punishment for the top grand larceny charge, after complying with his deal and testifying truthfully.

He is the only person charged in the Manhattan district attorney’s three-year investigation of Trump and his business practices.

In a statement on Tuesday, the DA, Alvin Bragg, said: “In Manhattan, you have to play by the rules, no matter who you are or who you work for.”

He said Weisselberg “used his high-level position to secure lavish work perks such as a rent-free luxury Manhattan apartment, multiple Mercedes-Benz automobiles and private school tuition for his grandchildren – all without paying required taxes.”

He added that Weisselberg “and two Trump companies have been convicted of felonies” and pointing to the executive’s jail sentence, Bragg hailed what he called “consequential felony convictions” that “put on full display the inner workings of former President Trump’s companies and its CFO’s actions”.

Weisselberg told jurors he conspired with a subordinate to hide more than a decade’s worth of perks. He said they fudged payroll records and issued falsified W-2 forms.

In December, a Manhattan jury convicted the Trump Organization and found that Weisselberg’s arrangement saved the company money because it didn’t have to pay him more.

Prosecutors said other Trump Organization executives also accepted off-the-books compensation. But only Weisselberg was accused of defrauding the federal government, state and city out of more than $900,000 in unpaid taxes and undeserved tax refunds.

Weisselberg testified that neither Trump nor his family knew about the scheme as it was happening, choking up as he told jurors: “It was my own personal greed that led to this.”

A Trump Organization lawyer, Michael van der Veen, said Weisselberg concocted the scheme without Trump or the Trump family’s knowledge.

Prosecutors said Trump “knew exactly what was going on” and that evidence, such as a lease he signed for Weisselberg’s apartment, made clear that “Mr Trump is explicitly sanctioning tax fraud”.

Weisselberg said the Trumps stayed loyal to him and that Trump’s eldest sons, entrusted to run the company while their father was president, gave him a $200,000 raise after an internal audit found he had been reducing his salary and bonuses by the cost of the perks.

The firm continued to pay Weisselberg $640,000 in salary and $500,000 in holiday bonuses. It punished him only nominally after his arrest in July 2021, reassigning him to senior adviser..

As part of the plea agreement, the judge, Juan Manuel Merchan, ordered Weisselberg to pay nearly $2m in taxes, penalties and interest, which as of 3 January he had paid. The judge also sentenced Weisselberg to five years’ probation.

Weisselberg would have faced up to 15 years in prison, the maximum punishment for the top grand larceny charge, had he reneged on his deal or not testified truthfully.

He is the only person charged in the Manhattan district attorney’s three-year investigation of Trump and his business practices.

In a statement on Tuesday, the DA, Alvin Bragg, said: “In Manhattan, you have to play by the rules, no matter who you are or who you work for.”

Weisselberg, he said, “used his high-level position to secure lavish work perks such as a rent-free luxury Manhattan apartment, multiple Mercedes-Benz automobiles and private school tuition for his grandchildren – all without paying required taxes.”

Saying Weisselberg “and two Trump companies have been convicted of felonies” and pointing to the executive’s jail sentence, Bragg hailed what he called “consequential felony convictions” that “put on full display the inner workings of former President Trump’s companies and its CFO’s actions”.

Weisselberg told jurors he conspired with a subordinate to hide more than a decade’s worth of perks. He said they fudged payroll records and issued falsified W-2 forms.

In December, a Manhattan jury convicted the Trump Organization and found that Weisselberg’s arrangement saved the company money because it didn’t have to pay him more.

Prosecutors said other Trump Organization executives also accepted off-the-books compensation. But only Weisselberg was accused of defrauding the federal government, state and city out of more than $900,000 in unpaid taxes and undeserved tax refunds.

Weisselberg testified that neither Trump nor his family knew about the scheme as it was happening, choking up as he told jurors: “It was my own personal greed that led to this.”

A Trump Organization lawyer, Michael van der Veen, said Weisselberg concocted the scheme without Trump or the Trump family’s knowledge.

Prosecutors said Trump “knew exactly what was going on” and that evidence, such as a lease he signed for Weisselberg’s apartment, made clear that “Mr Trump is explicitly sanctioning tax fraud”.

Weisselberg said the Trumps stayed loyal to him and that Trump’s eldest sons, entrusted to run the company while their father was president, gave him a $200,000 raise after an internal audit found he had been reducing his salary and bonuses by the cost of the perks.

The firm continued to pay Weisselberg $640,000 in salary and $500,000 in holiday bonuses. It punished him only nominally after his arrest in July 2021, reassigning him to senior adviser.