By Ben Kerrigan-

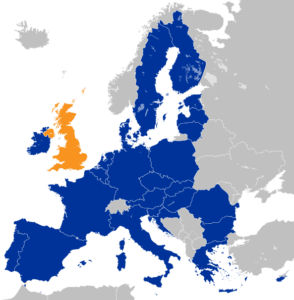

Political uncertainties in relation to Brexit is hampering UK economic growth, and need a speedy transitional deal to restore the UK’s economic prospects, according to the International Monetary Fund.

The IMF lowered its estimate for UK GDP growth in 2017 in response to the pessimistic effects drawn out talks between the UK and The EU is having on business confidence and expected future growth. The IMF’s output estimate for 2017 was downgraded from 1.7pc to 1.6pc, predicting a slowdown to 1.5pc in 2018. Christine Lagarde, the IMF’s managing director, said that the organisation’s warnings about growth ahead of the referendum have been borne out. Lagarde said there were causes for optimism, as long as a deal is struck quickly.

“The sooner there is a clear position as to what the outcome [of EU negotiations] will be, the better. A negotiation that drags on and on with massive uncertainty continuing is simply going to delay the plans, the strategies, the investment decision-making process of the whole corporate sector,” she said, welcoming the progress so far in the Brexit talks.

Ms Lagarde expressed positive anticipation that the EU’s negotiators to do more to reach a deal, as well as the UK’s team in Brussels.

“Our recommendations are that the authorities on both sides of the table try to reach hopefully mutually beneficial arrangements in order to eliminate as much as possible and as early as possible the uncertainty surrounding the economic circumstances of the UK,” she said.

Ms Lagarde also defended the controversial economic forecasts the IMF made before the referendum.

“Regrettably the numbers we are seeing today are actually proving the point that we made a year and a half ago [just before the Brexit vote] when people said, ‘you are too gloomy, you are one of those experts’,” she said.

“Unfortunately we were not too gloomy, we were pretty much on the mark, or within 0.1pc or so. Our forecast actually turned out to be the reality of the economy, which is one where sterling has depreciated, inflation has gone up, wages have been squeezed as a result and investment has been down, and certainly lower than we would expect it to be.”

The IMF warned that it was crucial to ensure that UK financial services, which make up 14pc of exports and 10pc of tax revenues, were protected in any Brexit deal. Failure to ensure continued uninhibited trade with the EU for financial services and other sectors, such as the automotive industry “would have significant impact on productivity growth”, it said.

BARRIERS

New barriers between the UK and EU to the cross-border flow of services, goods and workers, would present problems, the IMF said.

“The more the UK economy is open to trade in general, EU included, the more likely it is that productivity will go up and growth will increase,” said Ms Lagarde.

The IMF welcomed the progress in Brexit talks, which are expected to culminate in “understandings on a broad free trade agreement and on the transition process”. The IMF also said that Inflation will remain above target next year, with “pressure on real wages and consumption” It added that the future state of UK living standards would hinge on improvements to productivity levels, and that raising output per worker was crucial for overall economic performance.

The international analysts added that the UK had been efficient in reducing the budget deficit, and now needed to look to raise tax revenues rather than cutting spending.

“Significant progress has been made, clearly, in reducing the deficit since the global financial crisis – probably the most significant reduction in advanced economies in many years,” Ms Lagarde said

“But the UK’s public debt remains high at 87pc of GDP, so continued reduction in the deficit is critical to create further room to respond to future shocks.” That could include potentially unpopular steps such as moving the tax systems for employed and self-employed workers closer together – something the Chancellor tried but had to abandon earlier this year – as well as scrapping some of the VAT exemptions on goods typically deemed to be necessities.

And she warned that financial challenges will only grow in the years to come.

“Like many advanced economies, population aging is expected to lead to material increases in spending on healthcare, on pensions and on long-term care, while at the same time productivity has been low.”

“The slowly growing economy means fewer resources will be available to meet the increase in spending.”